Liability insurance is an essential type of coverage that offers protection against financial losses resulting from claims of injury or damage caused to others. It is a critical component for both individuals and businesses, ensuring that they can meet their legal responsibilities without facing devastating financial consequences. This article delves into the nuances of liability insurance, exploring its definition, various types, coverage details, exclusions, and financial implications, providing a comprehensive understanding of its importance and how it functions in the realm of insurance.

Key Takeaways

- Liability insurance is vital for protecting against lawsuits for injuries or damages caused to others, including incidents involving household members and pets.

- There are distinct differences between liability-only and full coverage insurance, with state regulations dictating minimum coverage requirements.

- Liability car insurance covers bodily injury and property damage caused by the policyholder in an at-fault accident, up to the policy's limits.

- Liability insurance does not cover personal medical costs, damages to the policyholder's own property, or incidents like theft, fire, and vandalism.

- The cost of liability insurance varies by state and is generally less expensive than full coverage, but it offers less financial protection for the policyholder's own property.

Understanding Liability Insurance

Definition and Purpose

Liability insurance is a critical component of risk management, providing a safety net for individuals and businesses alike. It is designed to protect against financial losses that may arise from being held legally responsible for an accident or injury. Liability coverage can extend to various scenarios, from automobile accidents to incidents on one's property.

- Financial protection in case of legal liability

- Coverage for accidents involving personal injury or property damage

- Protection for both individuals and businesses

Liability insurance is not just about legal compliance; it's about financial security and peace of mind.

Understanding the purpose and function of liability insurance is essential for anyone who owns property, drives a vehicle, or operates a business. It ensures that in the event you're found liable for someone else's medical bills or property repairs, you have the necessary financial support to address these obligations without devastating your finances.

Coverage for Household Members and Pets

Liability insurance is not just about protecting the policyholder; it extends its coverage to include other members of the household, such as family members and pets. This means that if your dog or cat accidentally causes injury or property damage, your liability insurance may cover the costs.

For renters, pet liability insurance is particularly significant. As highlighted by Forbes in their article on Pet Liability Insurance for Renters 2024, such insurance can be invaluable in mitigating the financial risks associated with pet-related incidents.

It's essential to understand the specifics of your policy, as coverage can vary. Some policies may offer comprehensive protection for pet-related liabilities, while others might have limitations or exclusions.

Remember, the inclusion of household members and pets under your liability insurance can provide peace of mind, knowing that you are protected against potential claims arising from accidents within your home or caused by your pets.

The Role of Liability Insurance in Lawsuits

Liability insurance plays a critical role in providing financial protection in the event of lawsuits. When an insured individual is sued for causing injury or damage, the policy covers legal defense costs and any resulting judgments or settlements, up to the policy's limits. This coverage is essential for mitigating the potentially devastating financial consequences of legal actions.

- Legal defense coverage: Attorney fees and court costs.

- Settlements and judgments: Payments awarded to the plaintiff.

- Policy limits: Maximum amount the insurance will pay.

Liability insurance ensures that the financial burden of a lawsuit does not fall solely on the individual's shoulders, offering a safety net that can be crucial in preserving personal assets.

It's important to understand that liability insurance does not grant carte blanche for negligent behavior. There are exclusions and limitations that policyholders must be aware of, which are typically outlined in the terms of the insurance contract.

Types of Liability Insurance Policies

Liability-Only vs. Full Coverage Insurance

When deciding between liability-only and full coverage car insurance, it's essential to understand the protection each option offers. Liability-only insurance covers damages you may cause to others, but it does not cover damages to your own vehicle. On the other hand, full coverage insurance includes liability protection and typically adds comprehensive and collision coverage, which pays for damages to your vehicle from various sources, such as accidents, theft, or natural disasters.

Choosing the right type of insurance depends on several factors, including the value of your vehicle, your financial situation, and whether your car is financed or leased.

Full coverage is generally more costly than liability-only due to the broader protection it provides. However, if you're financing or leasing a vehicle, full coverage is often mandatory. Below is a comparison of the two types of policies:

- Liability-Only Insurance: Cheaper premiums, covers damages to others, does not cover your own vehicle.

- Full Coverage Insurance: Higher premiums, covers damages to others and your own vehicle, often required by lenders.

State Requirements and Minimum Coverage

Each state in the U.S. has its own set of requirements for liability car insurance, with the exception of Virginia and certain rural areas of Alaska. Nearly every state mandates a minimum level of coverage that drivers must carry to legally operate a vehicle. These minimums are designed to ensure that all drivers can cover the cost of damages to others in the event of an accident.

The minimum coverage required by law varies from state to state, and it's crucial for drivers to be aware of these regulations to avoid legal penalties and ensure adequate protection.

While some states only require basic liability coverage, others may also mandate additional insurance types such as uninsured motorist coverage. It's important to note that even if your state has low minimum requirements, it may be wise to purchase higher limits to protect your assets, especially if you have a higher net worth.

Here's a quick overview of the minimum liability coverage requirements for a selection of states:

| State | Bodily Injury per Person | Bodily Injury per Accident | Property Damage |

|---|---|---|---|

| CA | $15,000 | $30,000 | $5,000 |

| FL | $10,000 | $20,000 | $10,000 |

| NY | $25,000 | $50,000 | $10,000 |

| TX | $30,000 | $60,000 | $25,000 |

Remember, these are just the minimums, and depending on your personal circumstances, you may need more comprehensive coverage.

Choosing the Right Liability Limits

Selecting the appropriate liability limits for your insurance policy is a crucial decision that can significantly impact your financial security. Most insurance professionals recommend higher liability coverage limits than the state's minimum to ensure greater protection in the event of an at-fault accident. It's important to consider not just the legal requirements but also your personal financial situation and the assets you need to protect.

When reviewing your policy, you'll encounter figures such as "25/50/25" which represent the maximum payout for bodily injury per person, per accident, and for property damage, respectively. These numbers are critical as they dictate the extent of coverage in various scenarios. If the costs exceed these limits, you will be responsible for the difference, potentially jeopardizing your savings and assets.

To determine the right coverage amount, assess your overall financial situation, the risks associated with your home, and the value of items on your property. Consulting with a licensed insurance agent can provide tailored guidance to match your needs.

Remember, while the minimum limits for liability are often set at $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 for property damage, these may not suffice in covering all expenses. Medical bills and car repairs can quickly surpass these amounts, leaving you liable for any shortfall.

What Does Liability Car Insurance Cover?

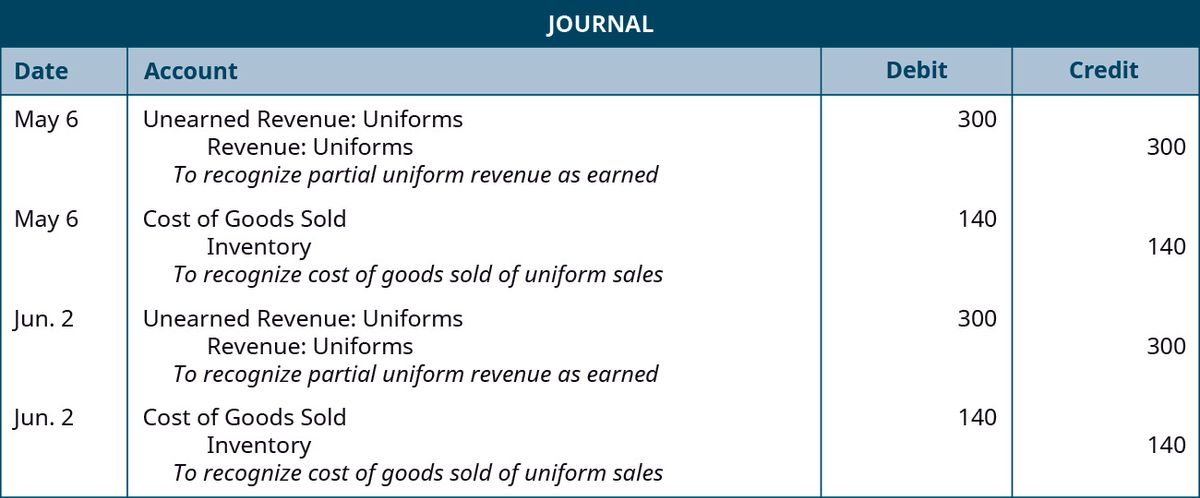

Bodily Injury Liability

Bodily injury liability is a critical component of liability car insurance, designed to protect you financially if you are at fault in an accident that injures another person. It covers expenses related to the other party's medical bills, rehabilitation, and lost income. This coverage is essential for safeguarding your assets against the high costs of medical care and legal fees that can arise from such incidents.

The limits of bodily injury liability are typically expressed in a per person / per accident format. For example, a limit of $25,000 per person means that the insurance will pay up to $25,000 for injuries sustained by each individual in an accident you cause. Additionally, there is a per accident limit, such as $50,000, which is the total amount the insurance will pay for all injuries in a single accident.

It's important to choose the right limits for your bodily injury liability coverage to ensure adequate protection. While higher limits can offer more security, they also come with higher premiums.

Understanding the structure of your liability limits is crucial when selecting your insurance policy. Some policies offer split limits, while others provide a combined single limit that can be applied flexibly to cover both injuries and property damage.

Property Damage Liability

Property damage liability insurance is a crucial component of auto insurance policies, covering the costs associated with damage to another person's property as a result of a car accident for which you are at fault. This includes not only other vehicles but also structures like fences and buildings, as well as public infrastructure such as guardrails and road signs. In some cases, it may extend to personal belongings inside the damaged property and provide for a rental car for the affected party.

The coverage limit for property damage liability is the maximum amount your insurance will pay for the total property damage you cause in an accident. Understanding your coverage limit is essential, as it dictates the extent of financial protection you have in these situations. Some insurers offer a combined single limit liability, which is a single, larger limit that encompasses both bodily injury and property damage, offering a more flexible coverage option.

Property damage liability does not only safeguard the interests of those whose property has been damaged, but it also serves to protect the policyholder from significant out-of-pocket expenses in the event of costly damages.

It's important to note that liability insurance is often split into two parts: bodily injury liability and property damage liability. The latter specifically addresses the costs of repairing or replacing property that you have damaged, ensuring that the affected parties are compensated and that your financial liability is managed.

Understanding Policy Coverage Limits

Liability car insurance limits dictate the maximum payout for claims under your policy. For instance, a policy with limits displayed as 25/50/25 means $25,000 for bodily injury per person, $50,000 for total injuries per accident, and $25,000 for property damage. It's crucial to choose limits that reflect your financial situation and the potential risks you face.

It's essential to understand that any costs exceeding your policy's limits will require out-of-pocket expenses. This could significantly impact your financial stability in the event of a major claim.

Remember, while higher limits can offer more protection, they also come with higher premiums. Balancing the cost against the coverage is a key aspect of selecting the right policy for you.

Exclusions in Liability Insurance

What's Not Covered?

While liability insurance is a critical component for financial protection, it's important to recognize its limitations. Liability insurance does not cover everything. For instance, it won't cover personal injuries or property damage that you or your household members sustain. Additionally, certain exclusions are standard across many policies:

- False arrest, imprisonment, or detention

- Malicious prosecution

- Wrongful eviction or entry

- Invasion of privacy

Liability insurance also excludes coverage for intentional acts, such as purposely injuring someone, and criminal acts like arson.

Moreover, damages from normal wear and tear or those related to business activities at home are not covered. It's essential to understand these exclusions to avoid unexpected financial burdens.

In the context of commercial general liability (CGL), specific exclusions can have significant implications. For example, a liquor liability exclusion means claims arising from the sale or distribution of alcohol are not covered. This is particularly relevant for businesses in the hospitality industry.

Limitations for Household Members and Personal Property

While liability insurance plays a crucial role in protecting against claims from others, it has clear boundaries when it comes to household members and personal property. Your liability insurance will not cover personal medical expenses or damages to your own property, even if the incident involves a third party. This limitation extends to injuries or damages that occur during the course of a home-based business operation.

- Punitive damages resulting from a lawsuit are also excluded.

- Intentional acts of harm or criminal activities, such as arson, are not covered.

- Normal wear and tear, including damage from animals or insects, falls outside the scope of liability insurance.

It's important to understand these exclusions to avoid unexpected financial burdens. Assessing your coverage needs and considering additional policies for personal protection can help bridge these gaps.

Scenarios Where Liability Insurance Does Not Apply

While liability insurance is a critical component for financial protection, there are certain scenarios where it does not provide coverage. These exclusions are crucial to understand to avoid unexpected financial burdens.

- Punitive damages in a lawsuit are typically not covered because they are intended to punish the wrongdoer rather than compensate the victim.

- Intentional acts, such as purposely injuring someone, are excluded as insurance is designed to cover unforeseen accidents, not deliberate harm.

- Criminal activities, like arson, fall outside the scope of liability insurance coverage due to their unlawful nature.

- Normal wear and tear, including damage from animals and insects, is not considered accidental and therefore is not covered.

- Business-related incidents that occur at home may require a separate business liability policy, as personal liability insurance often excludes business activities.

It's important to note that liability insurance is not a catch-all safety net. Understanding what is not protected under your policy can save you from significant legal and financial headaches.

Remember, liability insurance is designed to cover damages to others, not to the policyholder or their property. For instance, if you're involved in an accident, your liability insurance will cover the other party's expenses, but not your own. This distinction is vital in assessing the adequacy of your coverage.

Financial Implications of Liability Insurance

Cost Comparison: Liability-Only vs. Full Coverage

When comparing the costs of liability-only and full coverage insurance, it's essential to understand the scope of financial protection each provides. Liability-only insurance is typically less expensive because it covers damages you may cause to others in an at-fault accident, up to your policy's limits, without covering your own vehicle. In contrast, full coverage includes comprehensive and collision insurance, offering a broader safety net, which results in higher premiums.

The decision between liability-only and full coverage insurance should be informed by factors such as the value of your vehicle, your financial situation, and whether your vehicle is financed or leased.

Here's a simplified cost comparison based on average premiums:

| Insurance Type | Average Cost |

|---|---|

| Liability-Only | $500/year |

| Full Coverage | $1,200/year |

Note: The above figures are illustrative averages and actual costs will vary by state, vehicle type, and other factors.

Ultimately, while full coverage insurance is generally more expensive, it is often required for financed or leased vehicles and provides the advantage of higher liability limits and the option to add endorsements such as rental coverage and roadside assistance.

How State Regulations Affect Insurance Costs

The cost of liability insurance is significantly influenced by the state in which you reside. State-specific regulations, crime rates, and cost of living all play pivotal roles in determining your insurance premiums. For instance, states with higher rates of accidents or theft may see increased premiums due to a greater likelihood of insurance claims.

- States with stringent insurance laws often require higher minimum coverage, leading to increased base costs for policyholders.

- The prevalence of theft, vandalism, and accident statistics in an area can raise premiums, as insurers adjust for the heightened risk.

- Cost of living variations affect repair and medical costs, which in turn influence insurance rates.

Insurance costs are not uniform across the board; they are tailored to the unique risks and regulations of each state. This means that two individuals with similar profiles could pay vastly different premiums simply based on their location.

While individual driving records and vehicle types are significant factors, the state's regulatory environment can have an outsized impact on the overall cost of liability insurance. It's essential for consumers to understand how these state-level factors contribute to their insurance expenses.

Assessing the Value of Liability Insurance

When considering liability insurance, assessing its value involves weighing the cost against the financial protection it offers. The peace of mind that comes with adequate coverage can be invaluable, especially in the face of potential legal actions or claims against you.

- Higher Coverage Limits: Opting for higher liability limits can offer more financial security. The incremental cost increase is often minimal compared to the additional coverage provided.

- Umbrella Policies: For those seeking extra protection, umbrella liability policies extend coverage beyond standard limits.

The true value of liability insurance lies not just in fulfilling legal requirements, but in safeguarding your financial future from the unpredictable nature of accidents and lawsuits.

Evaluating the value of liability insurance also involves understanding the potential costs of not having sufficient coverage. A single incident can lead to financial ruin if one's assets are not adequately protected. Therefore, it is crucial to consider the long-term benefits and security that come with a comprehensive liability insurance policy.

Conclusion

In summary, liability insurance is an essential component of both home and auto insurance policies, designed to protect individuals from the financial repercussions of causing injury or damage to others. It covers legal responsibilities and expenses that may arise from at-fault accidents, but it does not extend to personal injuries or property damage sustained by the policyholder. While liability-only car insurance is a cost-effective option that satisfies state requirements, it is important to consider the benefits of full coverage insurance for more comprehensive protection. Ultimately, the choice between liability-only and full coverage insurance should be informed by an individual's specific needs, risks, and financial situation.

Frequently Asked Questions

What is liability insurance?

Personal liability insurance is a part of your home insurance policy that protects you against lawsuits for injuring or damaging someone else's property. This coverage also extends to other members of your household, including pets.

What's the difference between liability-only and full coverage insurance?

Liability-only car insurance covers damages you cause to others in an at-fault accident and is often the minimum required by states. Full coverage includes liability and also covers damages to your vehicle from collisions and non-collision incidents like storms and fires.

What does liability car insurance cover?

Liability car insurance covers bodily injury and property damage that you may cause to others while driving. It pays for the injuries and damages up to the limits of your policy and can protect you financially if you're sued.

What is not covered by liability insurance?

Liability insurance does not cover your personal medical costs, those of household members, or damages to your own property. It also does not cover events like theft, fire, vandalism, or hitting an animal.

How do I choose the right liability limits?

Choosing the right liability limits involves assessing your financial situation and the potential risks you face. It's recommended to carry higher limits than the state-required minimum to better protect your assets in case of an accident.

Is liability-only car insurance cheaper than full coverage?

Generally, liability-only car insurance is cheaper than full coverage because it provides less financial protection. Full coverage includes comprehensive and collision coverage, which offers financial protection for your vehicle.